FineArtX Ltd. is an online service platform born in 2022 with the aim of promoting contemporary art and supporting collectors in their investments through partnerships with selected companies, galleries, curators, art advisors and artists from allover the world. We asked the collector Jessica Zuttion, co-founder of this project, to deepen its specificities and some advice to orient ourselves in the increasingly labyrinthine reality of contemporary collecting.

Jessica Zuttion, co-fondatrice di FineArtX Ltd.

Andrea Guerrer: How does FineArtX differ from traditional artist-collector meeting channels such as galleries (physical and online), fairs and auctions? Would you like to briefly introduce us to the services that structure your project?

Jessica Zuttion: I can tell you that what we’re doing is definitely out of the ordinary. The art world often feels like an exclusive club, doesn’t it? A place where only members with the right credentials or the right pedigree can enter. Well, FineArtX wants to change all that. We are not just a channel for artists and collectors to meet. We are a tornado that is revolutionizing the way art is bought, sold and appreciated. While many traditional galleries are trapped in often elitist and geographically limited models, we are rolling the ball into the future. Thanks to our decades of experience in unrelated investments, our international profile and the magic of the web, we can offer artworks by emerging talents to collectors from all over the world. And we don’t stop there. Our focus is on emerging and mid-career artists who are experiencing an artistic and economic growth. We are here to let their talent shine and to give them the support and platform they deserve. In a nutshell, we are a reliable partner for investors who offer a complete experience: from research to authentication, from investment portfolio construction to exit strategy. And we always do it with an eye to emerging trends in the art world, such as NFTs and CryptoArt.

Ufficio Mayfair FineArtX Ltd., London

What are the advantages and main risks of investing in contemporary art?

Ah, contemporary art! A fertile ground for creative expression, a battlefield for ideas and, yes, a place to make bold and fruitful investments. Let’s start with the benefits, because let’s face it, we all love good news. First of all, contemporary art has proven to have a high rate of return in the medium to long term. No matter how fickle the stock market, a Basquiat will always remain a Basquiat. Art, unlike other forms of investment, is a safe haven – a sort of anti-crisis bunker. Then there is the matter of tax benefits. Art can be a tax haven, a sort of legal hiding place from heavy taxes. And let’s not forget the personal gratification that comes from owning an artwork. It is an emotional, aesthetic and cultural investment. But not all that glitters is gold. There are risks to investing in art such as authenticity and provenance can sometimes be difficult to verify, plus it can sometimes be costly to preserve. That’s where we come into play. Each purchase comes with a certificate of authenticity, which serves as a sort of passport for the artwork, confirming its origin. We offer a free insurance and storage service in dedicated warehouses where the artworks can be kept in controlled climatic conditions. We want our customers to have a completely stress-free experience.

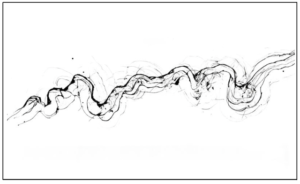

Serena Poletti, Forze silenziose 1, 2020, china su carta, courtesy FineArtX Ltd.

What is the minimum budget that an aspiring collector should have to embark on this adventure?

Kicking off your art venture as an investor is something you shouldn’t undertake without some cash. At FineArtX, we are fully aware that art is a medium to long-term investment and therefore requires an appropriate initial financial commitment. For those ready to explore the opportunities that investing in art can offer, our entry level packages start at €5,000. With such an investment, we are able to offer a diverse portfolio of artworks, acquiring pieces from a variety of emerging artists, each with their own unique style and potential for growth. This diversification not only increases the chances of high returns, but also reduces the risk associated with investing in a single artist or genre. It might seem tempting to “test” the market with a smaller investment, say 1,000 or 2,000 euros. But the truth is, an investment of this size positions you more as an enthusiast than a true investor. With a limited budget, the options for diversification become much scarcer and the return potential is significantly reduced. In conclusion, while art can certainly be appreciated on any level, if the goal is to see a significant return on investment, then it is necessary a serious financial commitment..

Tiziana Pers, Pandora 1, 2008, performance, print on Vision cotton paper mounted on dibond, courtesy R&P Contemporary Art and Prometeogallery Ida Pisani

A section of FineArtX is dedicated to emerging artists: what factors determine the initial value of their works and the subsequent fluctuations? How is the coefficient of an artwork calculated?

The art world may seem like a labyrinth to the uninitiated, but once you start to understand how things work, you find it to be a very logical system. When it comes to determining the initial value and subsequent fluctuations of emerging artists’ artwork, there are various factors at play. First, the artist himself/herself plays a decisive role. An artist with a solid reputation, exhibition resume and growing career will be of higher value than a lesser-known artist. This is a fact. Then there is the exclusivity of the artwork. One-of-a-kind works of art tend to have a higher value because the buyer is willing to pay more for the guarantee of being the sole owner. It’s a bit like having a customized race car versus a production model. Finally, market demand can influence the value of an artwork. The market value of a piece can fluctuate depending on the artist’s reputation, the popularity of the artwork and current demand. It’s a bit like stocks on the stock exchange. In the context of FineArtX, we rely on curators, gallery owners and professional consultants in the sector to monitor the market and select the most promising artists in terms of artistic research, growth potential and variety of techniques. For example, the artist Adonai is a perfect example of an emerging artist who has demonstrated significant growth over the past year, with a 20% increase thanks in part to the acquisition of one of his works by a major Italian museum. Additionally, one of his sculptures is currently on display at the DIFC Sculpture Park in Dubai. Another example is Tiziana Pers, a mid-career artist whose interview was recently published right here. Tiziana has also arrived among the finalists of the Premio Lissone 2023 at MAC Museum of Contemporary Art in Lissone, one of the most important contemporary art museums in Italy. The artistic coefficient is a concept used in the art world to determine the value of an artwork. It’s calculated based on a number of factors, including the size of the work and the reputation of the artist. The general formula for calculating the artistic coefficient is as it follows: [(base + height) x coefficient] x 10 = Price of the work. The base and height refer to the physical dimensions of the artwork. The coefficient is a numerical value that is determined and agreed upon by the gallery owner together with the artist. This value may vary according to the technical and artistic growth of the artist. For example, if an artist has a 2 factor and the work is 70cm high and 50cm wide, the calculation would be: (70+50) x 2 x 10 = 2400. Thus, the price of the the work would be 2400 euros. However, it is important to note that an artist’s coefficient can change over time as he/she evolves. Usually, the coefficient of an emerging artist starts from 0.2-0.5 and increases over time.

Ilia Da Lozzo, Broken Fight, 2022, fotografia artistica povera, courtesy FineArtX Ltd.

On the other hand, what factors need to be taken into account when approaching the collecting of contemporary but already historicized masters?

When it comes to collecting works by already historicized contemporary masters, there’s a little science and a little art to the process. First, it is essential to have an idea of the artist’s value in the art market. These artists already have established followings and their artwork is often in high demand. So, it’s not enough just to look at the price tag – you need to do a thorough research to figure out if the asking price for an artwork reflects its true value in the market. The provenance of the artwork is then another crucial element to consider. Knowing its history, who has previously owned it or where it was exhibited, can provide valuable information on its authenticity and value. And don’t forget accompanying documentation, such as certificates of authenticity, which can serve as further assurance that you’re buying a legitimate piece. Also, never underestimate the condition of the artwork. Even the smallest damage can have a significant impact on value, so it’s crucial you do a careful examination before proceeding with your purchase. Do not hesitate to involve an expert to make a professional assessment. And finally, when collecting historicized contemporary masters, it is important to consider consistency with the rest of your collection. If you have a specific style or theme in mind, you’ll want to make sure your new acquisitions blend seamlessly with existing artwork.

Federico Aprile, Reproduction, 2020, olio e gesso su carta, courtesy FineArtX Ltd.

In addition to the significant increase in the online art market, the last few years have also seen the exponential growth of NFT Art and Crypto Art. How do they differ and what are the specificities of these new types of digital objects?

Digital art is the new battle cry in the art world! NFT Art is artwork tokenized as Non-Fungible Tokens (NFT), a special type of cryptocurrency that represents a unique digital asset. This means that you cannot simply exchange it for another like you would with Bitcoin or Ethereum. Each NFT Art is unique in the world, just like a physical artwork. This uniqueness makes them irresistible to artists and collectors. On the other hand, we have Crypto Art, a term that covers digital art that takes advantage of blockchain technology to prove authenticity and ownership. Not all Crypto Art is NFT, but every NFT Art falls into the Crypto Art category. The beauty of these new digital art forms lies in how they interact with blockchain technology. This technology offers an immutable, public record of all transactions, meaning that the provenance and ownership of a digital artwork can be traced and verified. Artists can also incorporate royalties into their work, receiving a percentage of each future sale. In conclusion, both NFT Art and Crypto Art are revolutionizing the way art is created, bought and sold. They offer new opportunities for artists and collectors, but also present new challenges in terms of regulation and understanding of their intrinsic value. So, yes, we are experiencing a real revolution in art – and I can’t wait to see where it takes us!

Info:

Actor and performer, he loves visual arts in all their manifestations.

NO COMMENT